Many Malaysians think finance is complicated, full of numbers, investments, and difficult terms. But in reality, finance simply means how you manage your money every day.

Easy finance is about handling money in a simple, practical, and stress-free way. It’s suitable for students, fresh graduates, salaried workers, and even small business owners.

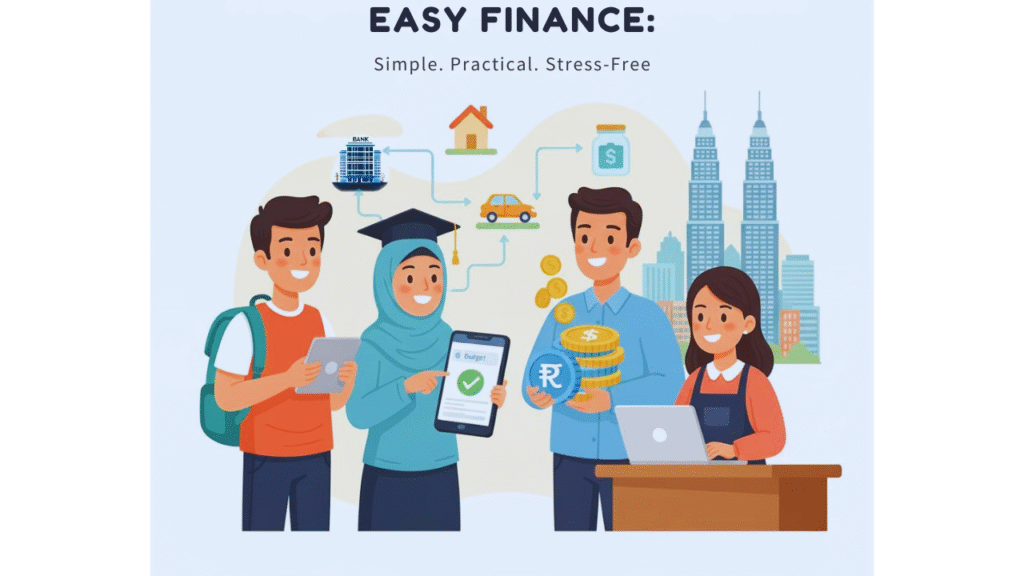

Why Easy Finance Matters in Malaysia

With the rising cost of living from petrol prices, tolls, groceries, to PTPTN loans, many people feel their salary disappears quickly each month. Easy finance helps you:

- Understand your cash flow – know where your monthly salary goes.

- Avoid unnecessary debt – like credit cards or personal loans.

- Prepare for the future – through ASB, Tabung Haji, or EPF savings.

When finances feel easy, life becomes more peaceful and less stressful.

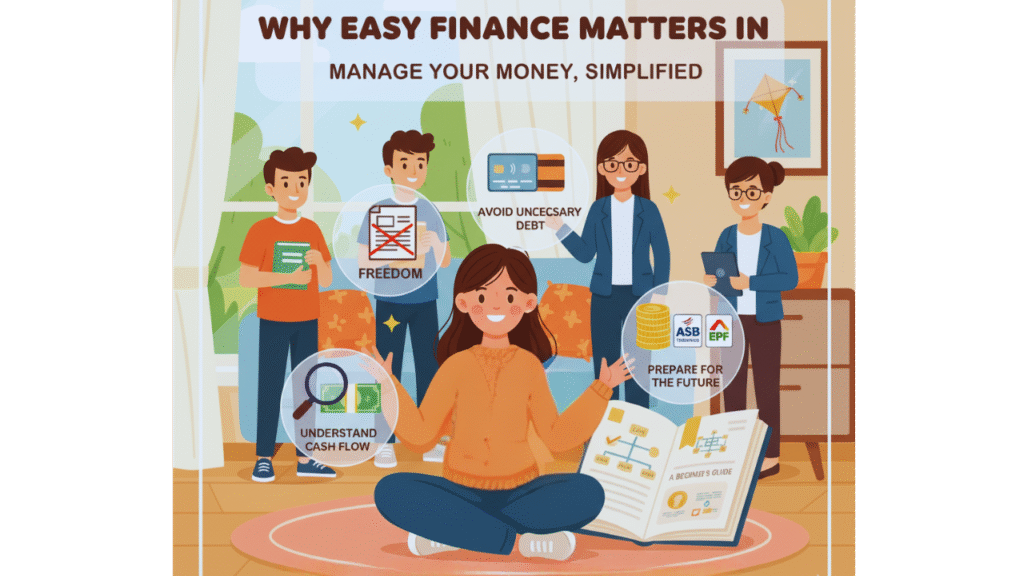

5 Easy Finance Tips for Malaysians

- Track Your Daily Expenses

Use e-wallets (Touch ‘n Go eWallet, MAE, Boost) or a simple notebook. You’ll see clearly if your money is going more to food, Shopee, or bills. - Apply the 50/30/20 Salary Budget Rule

- 50% for needs (rent, bills, groceries).

- 30% for wants (shopping, entertainment, travel).

- 20% for savings & investments (ASB, Tabung Haji, EPF i-Saraan).

- Build an Emergency Fund

Aim for at least 3–6 months of expenses in savings. This helps during job loss, car breakdowns, or family emergencies. - Pay Debts Smartly

Focus on clearing high-interest loans first (like credit cards). For PTPTN, pay consistently because a clean CCRIS record is important when applying for housing or car loans. - Save Before You Spend

Set auto-transfer as soon as your salary comes in. For example, RM200 straight into ASB or Tabung Haji every month. Over time, this grows into a strong financial safety net.

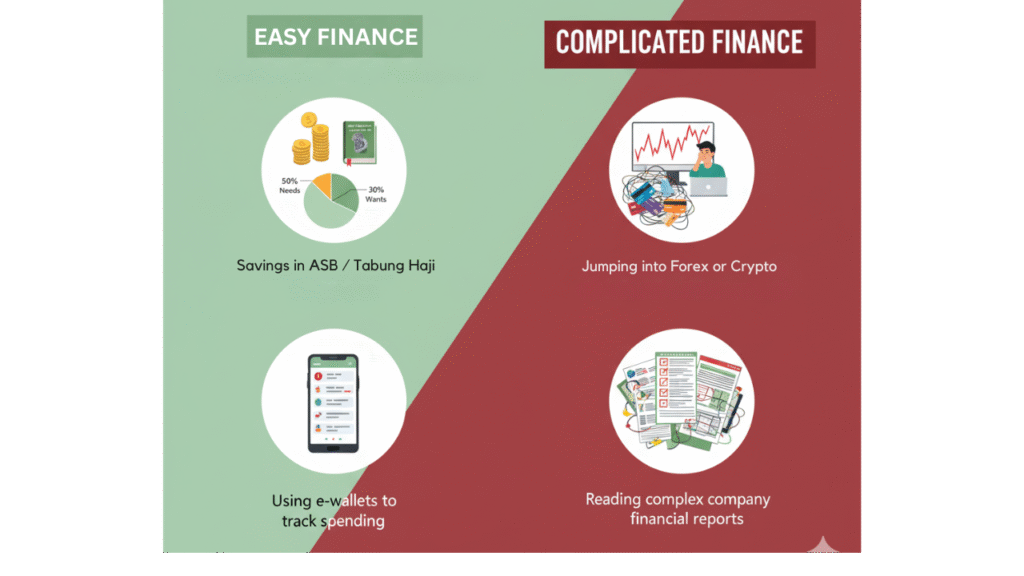

Easy Finance vs. Complicated Finance in Malaysia

| Easy Finance | Complicated Finance |

|---|---|

| Monthly savings in ASB / Tabung Haji | Jumping into forex or crypto without knowledge |

| Simple 50/30/20 budget plan | Multiple loans & heavy credit card debts |

| Using e-wallets to track spending | Reading complex company financial reports |

Final Thoughts

Easy finance in Malaysia isn’t about being a financial expert, it’s about managing salary, debt, and savings in a practical way. With a little discipline, everyone whether student, employee, or small business owner can achieve financial stability without stress.

Start small today, and you’ll enjoy a more secure tomorrow.