Managing money can feel overwhelming, especially if you’re just starting your financial journey. One of the easiest and most popular budgeting methods is the 50/30/20 rule. It’s a straightforward way to manage your income, control spending, and build savings for the future.

Understanding the 50/30/20 Rule

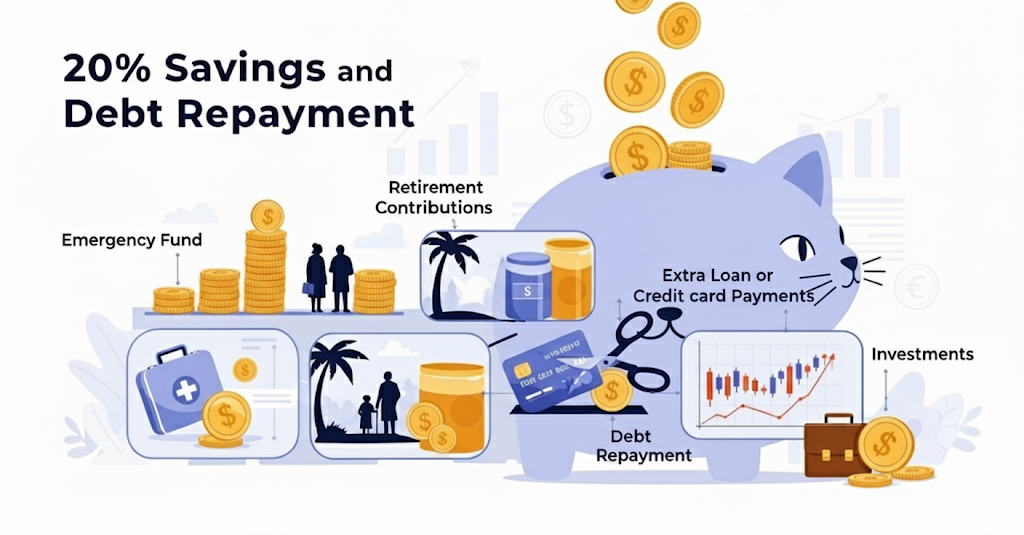

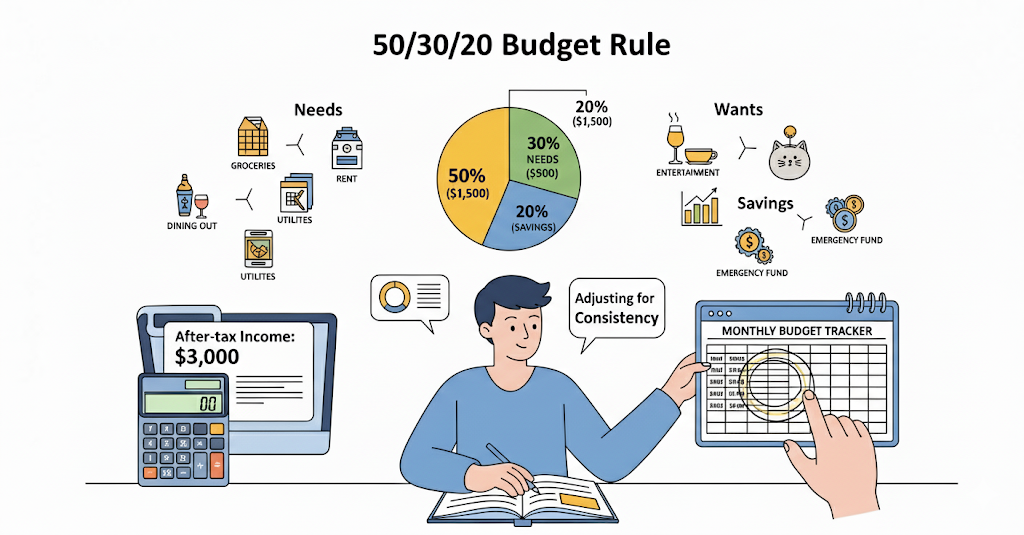

The 50/30/20 rule in finance is a budgeting guideline that divides your after-tax income into three main categories:

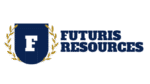

- 50% Needs

Half of your income should be allocated to essentials. These are expenses you cannot avoid, such as:- Housing (rent or mortgage)

- Utilities (electricity, water, internet)

- Groceries

- Transportation

- Insurance and minimum debt payments

- 30% Wants

Around one-third of your income can go toward non-essential expenses, or the things that add comfort and enjoyment to your life. This may include:- Dining out

- Subscriptions (Netflix, Spotify, etc.)

- Hobbies and entertainment

- Travel and leisure

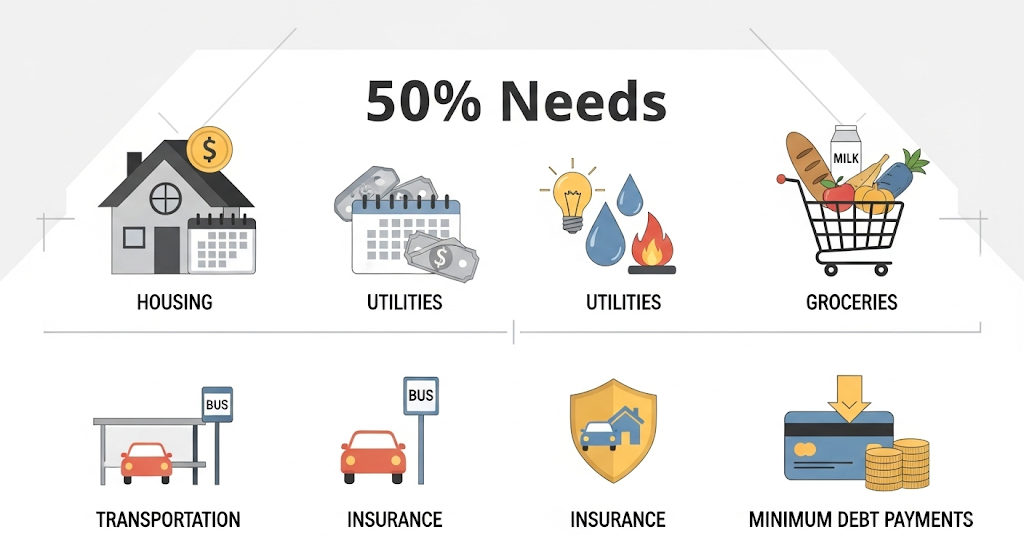

- 20% Savings and Debt Repayment

The remaining 20% should go toward strengthening your financial future. This can include:- Emergency fund savings

- Retirement contributions

- Extra loan or credit card payments

- Investments

Why the 50/30/20 Rule Works

The biggest advantage of the 50/30/20 budgeting method is its simplicity. It doesn’t require complicated spreadsheets or financial expertise. Instead, it provides a clear framework to ensure you’re not overspending while still enjoying life and preparing for the future.

Some key benefits include:

- Balanced spending – You cover needs first, enjoy wants, and still save.

- Flexibility – You can adjust percentages slightly based on your lifestyle.

- Clarity – It helps you visualize where your money goes each month.

How to Apply the 50/30/20 Rule in Your Life

- Calculate your after-tax income – Use your take-home pay as the starting point.

- Track your expenses – Categorize them into needs, wants, and savings.

- Adjust where necessary – If your “wants” exceed 30%, consider cutting back and redirecting money toward savings.

- Stay consistent – Budgeting works best when applied regularly.

Final Thoughts

The 50/30/20 rule in finance is an excellent starting point for anyone looking to take control of their money. While it may not fit every single financial situation, it offers a practical framework to balance spending, enjoy your lifestyle, and build long-term financial security.

By following this rule, you can simplify your budget, avoid overspending, and move closer to achieving your financial goals.